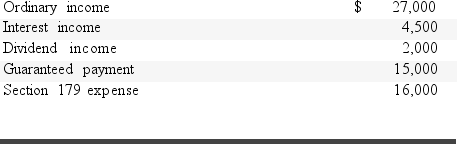

A partner had the following items reported on a partnership Schedule K-1:  The partner's self-employment income for the year is:

The partner's self-employment income for the year is:

A) $64,500.

B) $48,500.

C) $32,500.

D) $26,000.

Correct Answer:

Verified

Q51: Paris,a 60% partner in Omega Partnership,has a

Q52: Sabrina has a $12,000 basis in her

Q53: Partner Jamie has a basis of $10,000

Q54: Rental income and expenses are treated as:

A)Separately

Q55: Rich is a partner in RKW partnership.Rich

Q57: A partner had the following items reported

Q58: A partnership has $23,000 of depreciation expense

Q59: Parker,a 25% partner in Delta Partnership,has a

Q60: Sabrina has a $12,000 basis in her

Q61: Callie contributes the following assets to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents