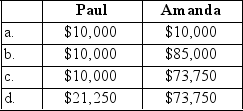

Paul invests $10,000 cash in an equipment leasing activity for a 15% ownership share in the business.The remaining 85% owner is Amanda.Amanda contributes $10,000 and personally borrows $75,000 that she also invests in the business.What are the at-risk amounts for Paul and Amanda?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q34: There is no difference between regular tax

Q34: Bailey owns a 20% interest in a

Q35: How much,in rental losses,can an individual earning

Q36: Generally,the gains and losses recognized for regular

Q37: Stuart owns a 20% interest in a

Q39: What form must a taxpayer file if

Q40: The at-risk amount is increased each tax

Q41: Randall invested $200,000 in Activity A and

Q42: Tax preference items for AMT:

A)Can only result

Q43: Jacob is single with no dependents.During 2016,Jacob

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents