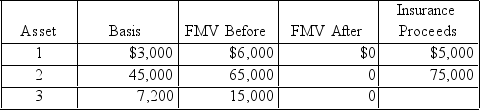

Knox operated a business which was damaged by a hurricane.His losses were as follows:

a.What is Knox's net casualty loss if any)assuming his AGI is $85,000 prior to the deduction? Assume he properly replaced all assets.

a.What is Knox's net casualty loss if any)assuming his AGI is $85,000 prior to the deduction? Assume he properly replaced all assets.

b.What is his basis in replacement Asset 1 purchased for $8,000 assuming Knox elected the non-recognition of gain from an involuntary conversion?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Libby exchanges a building she uses in

Q63: Richard's business is condemned by the state

Q65: A warehouse with an adjusted basis of

Q66: Dr.and Mrs.Spankle purchased a residence on January

Q68: On February 12,2016,Nelson sells stock basis $175,000)to

Q69: On June 15,2016,Roco sold land held for

Q70: Julia exchanges a machine used in her

Q70: Louis,who is single,sold his house in St.Louis

Q71: On July 1,2016,DJ sold equipment used in

Q72: Basil,who is single,purchased a house on May

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents