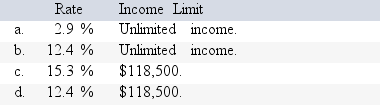

For 2016,what is the social security tax rate and income limit for a self-employed individual?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q21: For a cash-basis taxpayer,any account receivable that

Q33: If an activity is characterized as a

Q38: Paola purchased an office building on January

Q39: If inventory is a material amount,what method

Q41: Chris runs a business out of her

Q43: Cole purchased a car for business and

Q44: Which of the following individuals can deduct

Q45: The standard mileage rate encompasses all of

Q46: Deductible education expenses include all of the

Q47: In order for an employee to deduct

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents