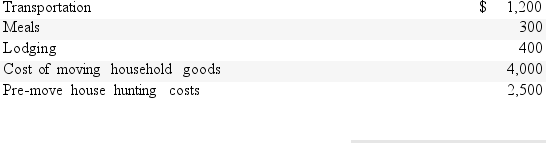

Due to a company consolidation,Renaldo transfers from Boston to San Diego.Under a new job description,he is reclassified from department manager to a staff member.His moving expenses,which are not reimbursed,are as follows:  Renaldo's deductible moving expense is:

Renaldo's deductible moving expense is:

A) $8,400.

B) $5,600.

C) $1,900.

D) $4,400.

Correct Answer:

Verified

Q87: What percentage of medical insurance premium payments

Q88: Jena is a self-employed fitness trainer who

Q89: Which of the following is not a

Q90: For 2016,taxpayers are eligible to take a

Q91: Sade,who is single and self-employed as a

Q93: Employer contributions to fund an eligible Health

Q94: If a taxpayer withdraws his or her

Q95: As a for AGI deduction,the expense for

Q96: Qualified education expenses for the purpose of

Q97: The for AGI deduction for the self-employment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents