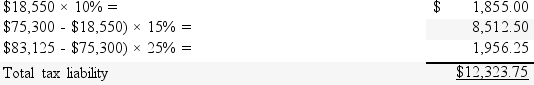

A married couple has taxable income of $83,125 and tax liability of:

Determine their marginal tax rate and their average tax rate.Round your answers to 2 decimal places)

Determine their marginal tax rate and their average tax rate.Round your answers to 2 decimal places)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q119: For equivalent amounts of taxable income,the total

Q120: Victoria determined her tax liability was $6,451.Her

Q123: The following court hears only tax cases:

A)U)S.District

Q126: What is the definition of a proportional

Q127: Determine the tax liability in each of

Q129: Alex is single and had W-2 income

Q130: Circular 230 applies to paid tax preparers.The

Q131: What is the definition of a regressive

Q137: Which type of tax rate structure is

Q139: What is the average tax rate and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents