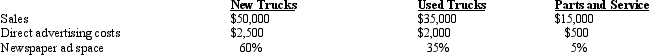

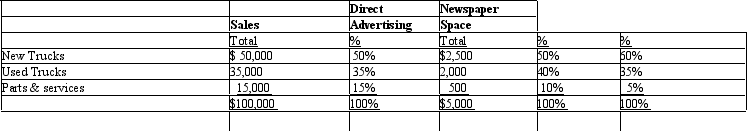

Silver Chariots Trucking Company incurred $5,000 of indirect advertising costs for its operations. The following data have been collected for 2014 for its three departments:

Required:

Required:

Determine the costs assigned to each department using the following activity drivers:

Correct Answer:

Verified

Q31: Which of the following methods allocates joint

Q68: Describe the differences between support and producing

Q152: Foster Company incurred $200,000 to manufacture the

Q153: Carson Wood Products processes logs into four

Q155: Figure 7-7 Garden of Eden Company manufactures

Q158: Algonquin Products produces two products, X and

Q159: Which joint cost allocation method is described

Q160: Algonquin Products produces two products, X and

Q161: Albemarle, Inc., has two producing departments. Each

Q162: Saturn Company manufactures products X, Y, and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents