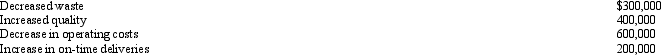

Bellamy Company is considering the purchase of a computerized manufacturing system. The after-tax cash benefits/savings associated with the system are as follows:  The system will cost $9,000,000 and will last ten years. The company's cost of capital is 12 percent.

The system will cost $9,000,000 and will last ten years. The company's cost of capital is 12 percent.

Which of the following best describes the IRR for this project?

A) between 14 and 16%

B) between 12 and 14%

C) between 10 and 12%

D) between 8 and 10%

Correct Answer:

Verified

Q97: Explain what a capital investment decision is.

Q106: A postaudit compares

A)estimated benefits and costs with

Q108: Vendome Company is considering the purchase of

Q110: Wastenot Production Company is considering the purchase

Q110: Bodacious Company is considering the purchase of

Q111: Under the current tax law, an asset

Q113: Vendome Company is considering the purchase of

Q114: Fill in the lettered blanks in the

Q115: Information about a project Wunderbar Company is

Q116: A corporation with taxable income of $400,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents