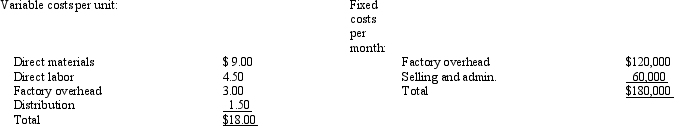

Modesto Company produces CD Players for home stereo units. The CD Players are sold to retail stores for $30. Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

A San Diego wholesaler has proposed to place a special one-time order of 10,000 units at a reduced price of $24 per unit. The wholesaler would pay all distribution costs, but there would be additional fixed selling and administrative costs of $3,000. All other information remains the same as the original data. What is the effect on profits if the special order is accepted?

A) increase of $12,000

B) increase of $57,000

C) increase of $75,000

D) decrease of $168,000

Correct Answer:

Verified

Q102: Describe the steps in the decision-making process.

Q109: Rosario Manufacturing Company had the following unit

Q110: Information about three joint products follows:

Q111: Information about three joint products follows:

Q112: What are relevant costs? How do they

Q113: Wallyworld Company manufactures a product with the

Q115: Wallyworld Company manufactures a product with the

Q117: The following three situations are given for

Q118: Gandolph Company manufactures a product with the

Q119: Davidian Company uses a joint process to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents