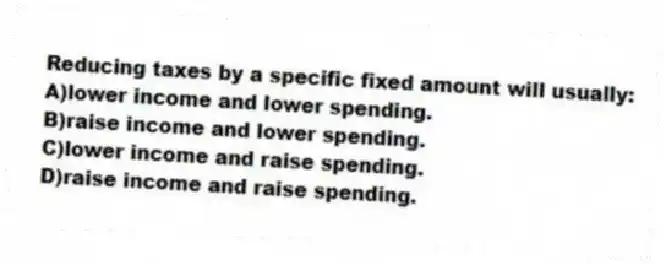

Reducing taxes by a specific fixed amount will usually:

A) lower income and lower spending.

B) raise income and lower spending.

C) lower income and raise spending.

D) raise income and raise spending.

Correct Answer:

Verified

Q74: The tax multiplier:

A)is negative.

B)is larger in absolute

Q75: If the absolute value of the tax

Q76: A cut in tax rates affects equilibrium

Q77: The government purchases multiplier will be larger

Q78: Assume in a closed economy that taxes

Q81: Explain why the 'tax multiplier' is different

Q84: If policy makers implement expansionary fiscal policy

Q152: A change in tax rates

A)has a less

Q202: An increase in government spending lowers interest

Q306: Assuming a fixed amount of taxes and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents