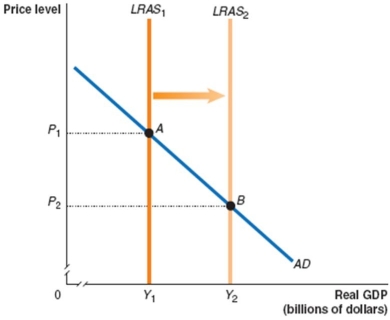

Figure 17.6

-Suppose the federal government reduces income taxes.Assume that the movement from A to B in Figure 17.6 represents normal growth in the economy before the tax change.If the tax change is not effective and labour supply and savings do not increase because of the tax change,then the tax change will

A) decrease the price level below P2.

B) increase output above Y2.

C) not change the price level.

D) shift LRAS2 to the right.

Correct Answer:

Verified

Q101: What is 'long-run crowding out'?

_

_

Q102: A federal budget deficit acts as an

Q115: Borrowing to pay for long-term capital expenditures

Q119: Government deficits tend to increase during:

A)recessions and

Q124: A law requiring the government to balance

Q132: If tax reduction and simplification are effective,

Q135: Reducing the marginal tax rate on individual

Q137: The 'Phillips curve' illustrates that there is

Q141: Figure 17.6 Q298: How can tax simplification be beneficial to![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents