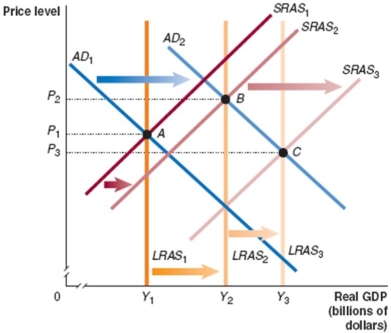

Show the impact of tax reduction and simplification using the dynamic aggregate demand and aggregate supply model.Clearly show and identify the impact of the tax change.Show what happens to the price level and real GDP because of the tax change.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: The 'Phillips curve' shows the short-run relationship

Q126: The _ the tax wedge, the smaller

Q127: An increase in income taxes will reduce

Q129: Fiscal policy actions that are intended to

Q131: Explain how lowered taxes on capital gains

Q138: If tax reduction and simplification are effective,

Q155: What is the cyclically adjusted budget deficit

Q161: Use the following information to draw a

Q262: As the tax wedge associated with a

Q279: Tax reduction and simplification should _ long-run

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents