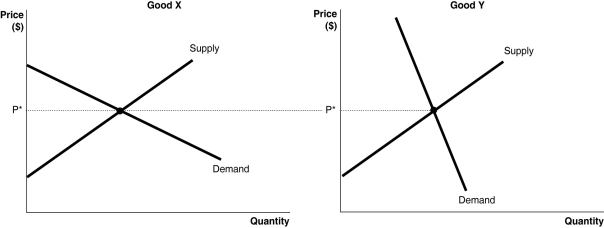

Figure 4-11

-Refer to Figure 4-11.The figure above illustrates the markets for two goods,Good X and Good Y.Suppose an identical dollar tax is imposed in each market.

a.Compare the consumer burden and producer burden in each market.Illustrate your answer graphically.

b.If the goal of the government is to raise revenue with minimum impact to quantity consumed,in which market should the tax be imposed?

c.If the goal of the government is to discourage consumption,in which market should the tax be imposed?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q182: A tax is efficient if it imposes

Q184: If the quantity of donuts supplied is

Q186: What is "tax incidence"? What determines tax

Q188: The following equations represent the demand and

Q189: One result of a tax is an

Q190: If the quantity of soccer balls demanded

Q191: If the quantity of fishing poles demanded

Q192: If the price of chewing gum is

Q195: What do economists mean by an efficient

Q198: Table 4-6

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents