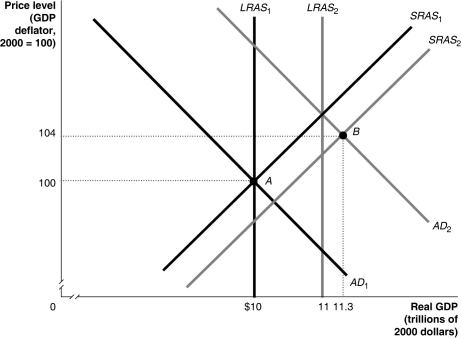

Figure 26-7

-Refer to Figure 26-7.In the dynamic AD-AS model,if the economy is at point A in year 1 and is expected to go to point B in year 2,the Federal Reserve would most likely

A) increase interest rates.

B) decrease interest rates.

C) not change interest rates.

D) increase the inflation rate.

Correct Answer:

Verified

Q93: Table 26-2 Q98: Figure 26-7 Q145: Table 26-1 Q172: In reality,the Fed is unable to use Q174: From an initial long-run macroeconomic equilibrium,if the Q183: The supporters of a monetary growth rule Q187: Use the dynamic aggregate demand and aggregate Q192: Most of the pressure for a monetary Q199: Suppose that the Federal Reserve Open Market Q210: Using the Taylor rule,if the current inflation Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents

![]()

![]()

![]()