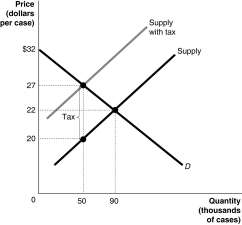

Figure 4-8  Figure 4-8 shows the market for beer. The government plans to impose a unit tax in this market.

Figure 4-8 shows the market for beer. The government plans to impose a unit tax in this market.

-Refer to Figure 4-8.As a result of the tax,is there a loss in consumer surplus?

A) Yes, because consumers paying a price above the economically efficient price.

B) No, because the producer pays the tax.

C) No, because the market reaches a new equilibrium

D) No, because consumers are charged a lower price to cover their tax burden.

Correct Answer:

Verified

Q165: Figure 4-8 Q168: Figure 4-8 Q171: Economists have shown that the burden of Q178: Figure 4-8 Q181: If the price of hairspray is represented Q184: If the quantity of donuts supplied is Q186: What is "tax incidence"? What determines tax Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents

![]()

![]()

![]()