Partners A and B receive a salary of $16,000 and $14,000,respectively.They agree to share income equally.If the partnership has income of $280,000 in 20x5,the entry to close the income into their capital accounts is:

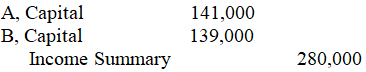

A)

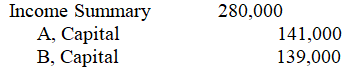

B)

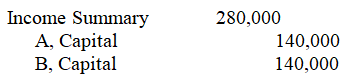

C)

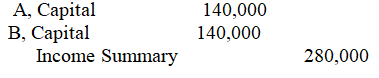

D)

Correct Answer:

Verified

Q64: When a partner invests assets other than

Q67: A partner invests into a partnership a

Q80: Noncash assets invested into a partnership are

Q81: Cortney invests $80,000 for a 10 percent

Q81: Delta and Chen form a partnership and

Q82: The division of partnership profits on the

Q82: April and Cammy are partners who have

Q83: Lexi invests $80,000 for a one-fourth interest

Q100: Which of the following will not result

Q129: List four advantages and four disadvantages of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents