Camp Corporation purchased 8,000 shares of Tent Corporation common stock for $80 per share on January 1,2014.Tent reported net income of $220,000 for 2014 and paid dividends of $90,000 during 2014.As of December 31,2014,the market value of Tent Corporation common stock was $80 per share.Assuming the shares owned by Camp represent 30 percent of the total outstanding stock of Tent,the entry to record the recognition of income by Camp Corporation is:

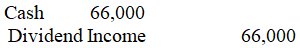

A)

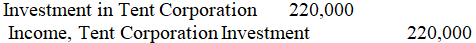

B)

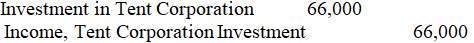

C)

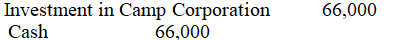

D)

Correct Answer:

Verified

Q71: Camp Corporation purchased 8,500 shares of Tent

Q81: A short-term investment in a U.S.Treasury bill

Q83: Sofranko Corporation purchased 8,000 shares of Bussey

Q84: When a corporation owns more than 50

Q86: Merckle Corporation owns 40 percent of the

Q90: Garcia Corporation purchased 22,000 shares of Lee

Q91: Use this information to answer the following

Q92: If the maturity date of Treasury bills

Q94: Winters Corporation purchased 15,000 shares of Poores

Q97: Winters Corporation purchased 15,000 shares of Poores

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents