A company receives $200,of which $8 is for sales tax and $12 is for excise tax.The journal entry to record the sale is:

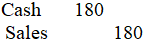

A)

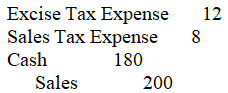

B)

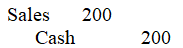

C)

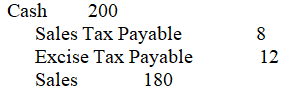

D)

Correct Answer:

Verified

Q88: Which of the following descriptions would not

Q89: What would be the adjusting entry for

Q90: All of the following can be employee

Q91: Sales Tax Payable is an example of

Q92: A company receives $360 for a sale,of

Q94: Payroll Taxes and Benefits Expense includes all

Q95: Which of the following most likely is

Q96: All of the following are classified as

Q97: Usually,failure to record a liability means failure

Q98: Which of the following taxes is not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents