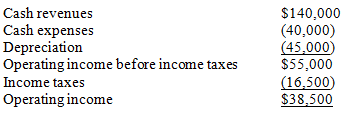

Medina Company has a tax rate of 30 percent and is considering a capital project that will make the following annual contribution to operating income:  Using the receipts and disbursements method,net cash inflows are

Using the receipts and disbursements method,net cash inflows are

A) $(83,500) .

B) $43,500.

C) $83,500.

D) $100,000.

Correct Answer:

Verified

Q78: Memphis Co.is considering purchasing a machine for

Q79: Lopez Co.is interested in purchasing equipment that

Q81: Conducting a preliminary screening of capital investment

Q82: You are given the following present value

Q133: Which of the following is true of

Q134: Discounting calculates the _ value of an

Q142: Annual net cash flows are defined as

A)annual

Q154: Which of the following is measured by

Q158: Assume revenues are received in cash and

Q159: Which of the following methods uses the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents