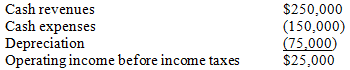

Perry Company has a tax rate of 30 percent and is considering a capital project that will make the following annual contribution to operating income before income taxes:  The impact of income taxes on net cash flows will be

The impact of income taxes on net cash flows will be

A) $(7,500) .

B) $(22,500) .

C) $(45,000) .

D) $(75,000) .

Correct Answer:

Verified

Q57: Jymo Company has a tax rate of

Q60: As part of the performing stage of

Q61: Sabrina Company has a tax rate of

Q64: Rodriguez Inc.is considering a project that costs

Q66: Boston Corp.is evaluating three projects.Each project will

Q67: Lopez Co.is interested in purchasing equipment that

Q100: Which of the following is true of

Q135: Depreciation expense influences cash flows because it

Q141: When using the net present value method

Q160: A project is accepted under the net

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents