The Pink Thai Restaurant is considering the purchase of a second oven that would accommodate its new take-out business.The oven would cost $17,000,has an estimated residual value of $5,000,and would be useful for six years.Annual net cash inflows would increase by $3,960.Pink Thai uses the straight-line method of depreciation.Using the above facts and the present value factors given below,calculate the following.

a.Payback period (Round your answer to one decimal place. )

b.Accounting rate of return (Round your answer to one decimal place. )

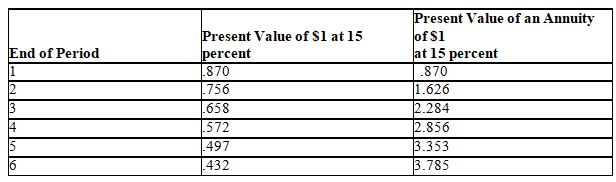

c.Net present value of the investment based on a 15 percent minimum desired rate of return (Use parentheses to indicate a negative net present value.Round your answer to the nearest dollar,if necessary. )

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q96: Making capital investment decisions based on the

Q97: Evaluating capital investment proposals prior to making

Q98: Upon completion of a capital investment project,what

Q99: Identifying capital investment needs falls under which

Q102: The Cal-Fruit Company specializes in decorative fruit

Q103: San Joaquin Manufacturing Company specializes in the

Q104: Valprado Industries is considering purchasing a machine

Q105: The Logan Company specializes in decorative fruit

Q106: Management of Moore City Trust is in

Q149: Why is the book value of equipment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents