The Pink Thai Restaurant is considering the purchase of a second oven that would accommodate its new take-out business.The oven would cost $17,000,has an estimated residual value of $5,000,and would be useful for six years.Annual net cash inflows would increase by $3,960.Pink Thai uses the straight-line method of depreciation.Using the above facts and the present value factors given below,calculate the following.

(a)Payback period (Round your answer to one decimal place. )

(b)Accounting rate of return (Round your answer to one decimal place. )

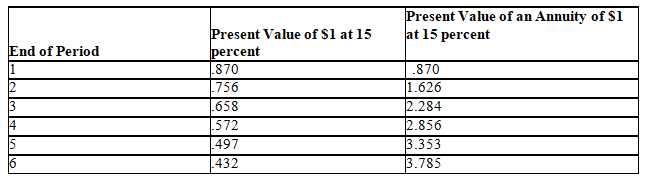

(c)Net present value of the investment based on a 15 percent minimum desired rate of return (Use parentheses to indicate a negative net present value.Round your answer to the nearest dollar,if necessary).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q149: Why is the book value of equipment

Q163: Sand Canyon Enterprises is analyzing its sales

Q165: On November 25,2014,Marquez Golf Co.received a special

Q166: What criteria must be met for accepting

Q166: What criteria must be met for accepting

Q168: The Dropinsky Company's management wants to determine

Q169: Courtney Sinclaire is trying to rent a

Q170: The Nick Lumber Company is in the

Q171: What are the two steps in the

Q172: You are given the following present value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents