A ten-year bond has a face value of $10,000,a face interest rate of 11 percent,an unamortized bond premium of $400,and an effective interest rate of 10 percent.The bonds were issued on one of its semi-annual interest payment dates.The entry to record the bond interest expense on the first semi-annual interest payment date is : (assuming the effective interest method of amortization) ,

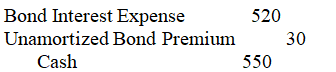

A)

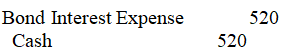

B)

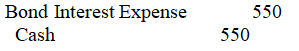

C)

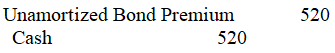

D)

Correct Answer:

Verified

Q132: Weller Co.issued $600,000 of 30-year,8 percent bonds

Q133: When bonds are issued at a discount,the

Q134: Suffolk Corporation issued $92,000 of 20-year,6 percent

Q135: On January 2,20x5,Barham Corporation issued ten-year bonds

Q136: Knollwood Corporation issued $278,000 of 30-year,8 percent

Q138: Knollwood Corporation issued $286,000 of 30-year,8 percent

Q139: Which of the following is not needed

Q140: On January 2,20x5,Preston Corporation issued 20-year bonds

Q141: Greco Co.issued ten-year term bonds on January

Q142: A $200,000 bond issue with a carrying

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents