The board of directors of Lark Corporation declared a cash dividend of $3.50 per share on 57,000 shares of common stock on June 14,20x5.The dividend is to be paid on July 15,20x5,to shareholders of record on July 1,20x5.The proper entry to be recorded on June 14,20x5 is,

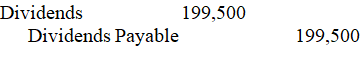

A)

B) No journal entry is necessary on this date.

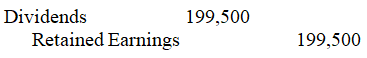

C)

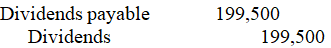

D)

Correct Answer:

Verified

Q129: On the balance sheet,treasury stock owned by

Q130: On June 1,20x5,Jomax Corporation had 60,000 shares

Q131: A corporation should account for the declaration

Q132: Use the following information to answer the

Q133: The entry to record the declaration of

Q135: A corporation records a dividend-related liability

A)on the

Q136: The entry to close the Dividends account

Q137: The board of directors of Lark Corporation

Q138: The board of directors of Lark Corporation

Q139: On July 1,20x5,Blaylock Corporation had 40,000 shares

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents