Partners B and I receive a salary allowance of $6,000 and $14,000,respectively,and share the remainder equally.If the company earned $8,000 during the period,the entry to close the income or loss into their capital accounts is:

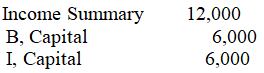

A)

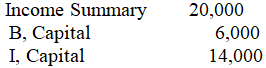

B)

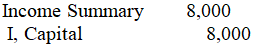

C)

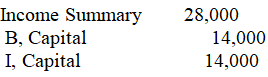

D)

Correct Answer:

Verified

Q86: Partners A and B receive a salary

Q87: Alex,Clinton,and Evan are in a partnership.Evan decides

Q88: Which of the following methods of distributing

Q89: Which of the following statements is correct

Q90: Which of the following will not result

Q92: Joan contributes cash of $48,000,and Jamie contributes

Q93: Chad invests $20,000 for a one-third interest

Q94: Which of the following statements is correct

Q95: Partners A and B receive a salary

Q96: Sara invests $120,000 for a 30 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents