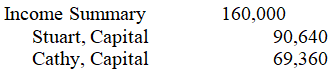

Stuart had a $100,000 capital balance for eight months and a $130,000 balance for four months.Cathy had a $76,000 capital balance for five months and a $100,000 balance for seven months.If the net income of the year is $160,000,and income is distributed based on average capital balances,the entry to show the distribution of income to each partner is:

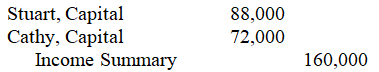

A)

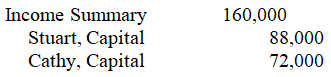

B)

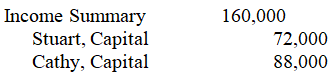

C)

D)

Correct Answer:

Verified

Q93: Chad invests $20,000 for a one-third interest

Q94: Which of the following statements is correct

Q95: Partners A and B receive a salary

Q96: Sara invests $120,000 for a 30 percent

Q97: Joan pays Eva $60,000 for her $40,000

Q99: A partner has a capital balance of

Q100: Which of the following will not result

Q101: A partnership agreement most likely will stipulate

Q102: In a partnership liquidation,the Gain or Loss

Q103: April and Cammy are partners who have

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents