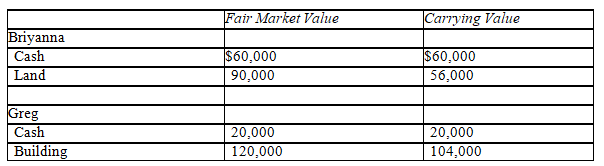

Briyanna and Greg form a partnership and invest the following assets and liabilities.Greg's building is subject to a $40,000 mortgage that is not assumed by the partnership. In the journal provided prepare the entry to record the formation of the partnership.(Omit explanation. )

In the journal provided prepare the entry to record the formation of the partnership.(Omit explanation. )

Correct Answer:

Verified

Q123: Erin,Rachel,and Travis are partners in ERT Company,with

Q124: Business organizations that mimic the characteristics of

Q125: Brandi and Hunter divide partnership income and

Q126: Chelsea,Jack,and Connor have a partnership.Chelsea wishes to

Q127: A limited partnership

A)allows some partners to limit

Q129: List four advantages and four disadvantages of

Q130: Describe how a dissolution of a partnership

Q131: Which of the following describes a special-purpose

Q132: A _ is an association of two

Q133: Which of the following describes a limited

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents