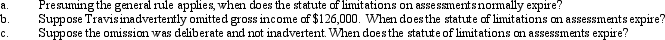

For the tax year 2010,Travis reported gross income of $500,000 on his timely filed Federal income tax return.

Correct Answer:

Verified

Q102: Which, if any, of the following provisions

Q102: Without obtaining an extension,Brandi files her income

Q103: Regarding proper ethical guidelines, which (if any)

Q105: In 1980,Jonathan leased real estate to Jay

Q106: Amy is the sole shareholder of Garnet

Q108: Due to the population change,the Goose Creek

Q109: Allowing a domestic production activities deduction for

Q112: A landlord leases property upon which the

Q133: In terms of Adam Smith's canons of

Q164: The Federal income tax is based on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents