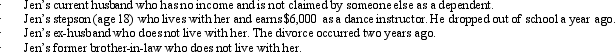

During 2010,Jen (age 66) furnished more than 50% of the support of the following persons:  Presuming all other dependency tests are met,on a separate return how many personal and dependency exemptions may Jen claim?

Presuming all other dependency tests are met,on a separate return how many personal and dependency exemptions may Jen claim?

A) Two.

B) Three.

C) Four.

D) Five.

E) None of the above.

Correct Answer:

Verified

Q71: During 2010,Justin had the following transactions:

Q72: In terms of the tax formula applicable

Q73: Tony,age 15,is claimed as a dependent by

Q74: Kyle and Liza are married and under

Q75: Which,if any,of the following is a deduction

Q77: Muriel,age 70 and single,is claimed as a

Q78: Which of the following items,if any,is deductible?

A)Parking

Q79: Wilma is a widow,age 80 and blind,who

Q80: Which,if any,of the following statements relating to

Q81: Nelda is married to Chad,who abandoned her

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents