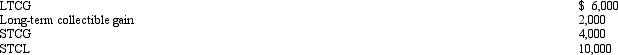

During 2010,Trevor has the following capital transactions:  After the netting process,the following results:

After the netting process,the following results:

A) Long-term collectible gain of $2,000.

B) LTCG of $6,000,Long-term collectible gain of $2,000,and a STCL of $6,000.

C) LTCG of $6,000,Long-term collectible gain of $2,000,and a STCL carryover to 2011 of $3,000.

D) LTCG of $2,000.

E) None of the above.

Correct Answer:

Verified

Q77: Muriel,age 70 and single,is claimed as a

Q78: Which of the following items,if any,is deductible?

A)Parking

Q79: Wilma is a widow,age 80 and blind,who

Q80: Which,if any,of the following statements relating to

Q81: Nelda is married to Chad,who abandoned her

Q83: Which,if any,of the following is a correct

Q84: For the qualifying relative rule (for dependency

Q85: Kirby is in the 15% tax bracket

Q86: Karen had the following transactions for 2010:

Q87: Emma had the following transactions during 2010:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents