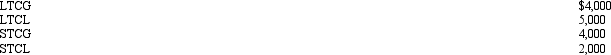

During 2010,Carmen had salary income of $90,000 and the following capital transactions:

How are these transactions handled for income tax purposes?

How are these transactions handled for income tax purposes?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q115: During the year,Marcus had the following transactions:

Q116: Mickey,age 12,lives in the same household with

Q117: Ashley earns a salary of $35,000,has capital

Q118: During 2010,Dena has the following gains and

Q120: Warren,age 17,is claimed as a dependent by

Q121: For the past few years,Corey's filing status

Q152: During the current year, Doris received a

Q155: The Martins have a teenage son who

Q158: Maude's parents live in another state and

Q162: List at least three exceptions to the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents