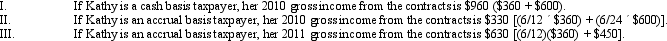

Kathy operates a gym.She sells memberships that entitle the member to use the facilities at any time.A one-year membership costs $360 ($360/12 = $30 per month) ;a two-year membership costs $600 ($600/24 = $25 per month) .Cash payment is required at the beginning of the membership period.On July 1,2010,Kathy sold a one-year membership and a two-year membership.

A) Only I is true.

B) Only I and II are true.

C) Only II and III are true.

D) I,II,and III are true.

E) None of the above.

Correct Answer:

Verified

Q61: Wayne owns a 25% interest in the

Q62: Jim and Nora,residents of a community property

Q63: With respect to the prepaid income from

Q63: On October 1,2010,Bob,a cash basis taxpayer,gave Dave

Q64: Harry and Wanda were married in Virginia,a

Q67: The underlying rationale for the alimony rules

Q68: Mike contracted with Kram Company,Mike's controlled corporation.Mike

Q69: Freddy purchased a certificate of deposit for

Q70: Daniel purchased a bond on July 1,2010,at

Q71: Orange Cable TV Company,an accrual basis taxpayer,allows

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents