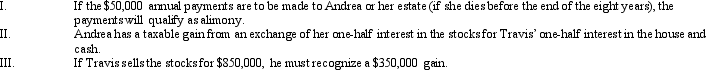

Travis and Andrea were divorced.Their only marital property consisted of a personal residence (fair market value of $400,000,cost of $200,000) ,and publicly-traded stocks (fair market value of $800,000,cost basis of $500,000) .Under the terms of the divorce agreement,Andrea received the personal residence and Travis received the stocks.In addition,Andrea was to receive $50,000 for eight years.

A) Only I and II are true.

B) Only I and III are true.

C) Only III is true.

D) I,II,and III are true.

E) None of the above are true.

Correct Answer:

Verified

Q83: Sharon made a $60,000 interest-free loan to

Q84: Thelma and Mitch were divorced.The couple had

Q95: Which of the following is not a

Q96: In the case of a below-market loan

Q99: Gordon,an employee,is provided group term life insurance

Q101: Melissa is a compulsive coupon clipper. She

Q102: Margaret made a $90,000 interest-free loan to

Q103: Ted paid $73,600 to receive $10,000 at

Q104: The taxable portion of Social Security benefits

Q105: Katherine is 60 years old and is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents