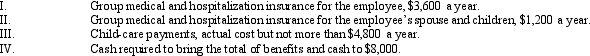

Under the Swan Company's cafeteria plan,all full-time employees are allowed to select any combination of the benefits below,but the total received by the employee cannot exceed $8,000 a year.  Which of the following statements is true?

Which of the following statements is true?

A) Sam,a full-time employee,selects choices II and III and $2,000 cash.His gross income must include the $2,000.

B) Paul,a full-time employee,elects to receive $8,000 cash because his wife's employer provided these same insurance benefits for him.Paul is required to include the $8,000 in gross income.

C) Sue,a full-time employee,elects to receive choices I,II and $3,200 for III.Sue is not required to include any of the above in gross income.

D) All of the above.

E) None of the above.

Correct Answer:

Verified

Q43: Olaf was injured in an automobile accident

Q57: Early in the year,Marcus was in an

Q58: Swan Finance Company,an accrual method taxpayer,requires all

Q59: Ron,age 19,is a full-time graduate student at

Q60: Ben was diagnosed with a terminal illness.His

Q62: The employees of Mauve Accounting Services are

Q63: Ridge is the manager of a motel.As

Q66: A U.S.citizen worked in a foreign country

Q70: Section 119 excludes the value of meals

Q78: All employees of United Company are covered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents