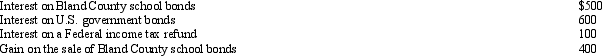

Heather's interest and gains on investments for 2010 were as follows:  Heather's gross income from the above is:

Heather's gross income from the above is:

A) $1,600.

B) $1,500.

C) $1,200.

D) $1,100.

E) None of the above.

Correct Answer:

Verified

Q87: Emily is in the 35% marginal tax

Q95: Tonya is a cash basis taxpayer.In 2010,she

Q96: Hazel,a solvent individual but a recovering alcoholic,embezzled

Q97: Louise works in a foreign branch of

Q98: Denny was neither bankrupt nor insolvent but

Q101: Chris was hospitalized for stomach problems.While he

Q102: Employers can provide numerous benefits to their

Q103: Carmen had worked for Sparrow Corporation for

Q104: What are the tax problems associated with

Q105: Describe a situation under which a company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents