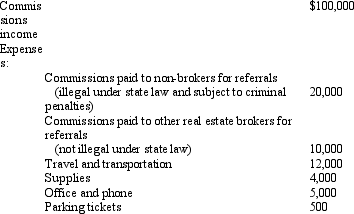

Angela,a real estate broker,had the following income and expenses in her business:  How much net income must Angela report from this business?

How much net income must Angela report from this business?

A) $48,500.

B) $49,000.

C) $60,000.

D) $68,500.

E) $69,000.

Correct Answer:

Verified

Q69: Payments by a cash basis taxpayer of

Q71: Agnes is the sole shareholder of Violet,Inc.For

Q73: Terry and Jim are both involved in

Q74: Tommy, an automobile mechanic employed by an

Q75: Which of the following is deductible as

Q77: Which of the following is not a

Q77: Vera is the CEO of Brunettes,a publicly

Q78: Iris,a calendar year cash basis taxpayer,owns and

Q80: Which of the following cannot be deducted

Q81: Priscella pursued a hobby of making bedspreads

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents