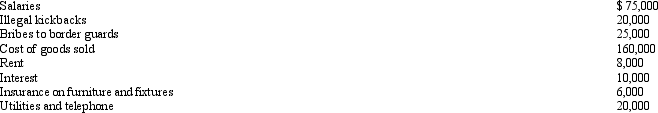

Tom operates an illegal drug-running operation and incurred the following expenses:  Which of the above amounts reduces his taxable income?

Which of the above amounts reduces his taxable income?

A) $0.

B) $160,000.

C) $279,000.

D) $324,000.

E) None of the above.

Correct Answer:

Verified

Q62: Rex,a cash basis calendar year taxpayer,runs a

Q63: Which of the following is incorrect?

A)Alimony is

Q64: Benita incurred a business expense on December

Q65: Swan,Inc.is an accrual basis taxpayer.Swan uses the

Q66: Which of the following is a deduction

Q70: Melvin is engaged in an illegal drug-running

Q71: Agnes is the sole shareholder of Violet,Inc.For

Q77: Which of the following is not a

Q78: Which of the following is correct?

A)A personal

Q89: Which of the following statements is correct

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents