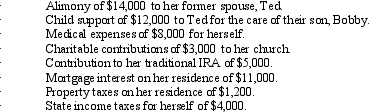

Amy incurs and pays the following expenses during the year:

Amy's only income is a $100,000 salary.Calculate Amy's deductions for AGI and from AGI.

Amy's only income is a $100,000 salary.Calculate Amy's deductions for AGI and from AGI.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q74: Tommy, an automobile mechanic employed by an

Q78: Iris,a calendar year cash basis taxpayer,owns and

Q80: Which of the following cannot be deducted

Q81: Priscella pursued a hobby of making bedspreads

Q82: Which of the following is not relevant

Q84: Because Scott is three months delinquent on

Q85: If a vacation home is determined to

Q86: For constructive ownership purposes,which of the following

Q87: Sarah incurred the following expenses for her

Q88: Cory incurred and paid the following expenses:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents