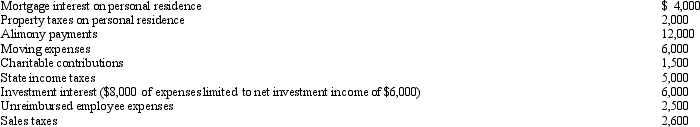

Arnold and Beth file a joint return.Use the following data to calculate their deduction for AGI.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: In January, Lance sold stock with a

Q96: Which of the following must be capitalized

Q97: Which of the following is not deductible?

A)Moving

Q98: On January 2,2010,Fran acquires a business from

Q99: Robyn rents her beach house for 60

Q101: Alex sells land with an adjusted basis

Q102: Woody owns a barber shop.The following selected

Q103: While she was a college student,Juliet worked

Q104: Sandra owns an insurance agency.The following selected

Q105: Brenda invested in the following stocks and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents