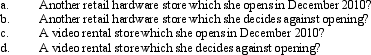

Gladys owns a retail hardware store in Tangipahoa.She is considering opening a business in Hammond,a community located 25 miles away.She incurs expenses of $60,000 in 2010 in investigating the feasibility and desirability of doing so.What amount can Gladys deduct in 2010 if the business is:

Correct Answer:

Verified

Q105: Brenda invested in the following stocks and

Q106: The stock of Eagle,Inc.is owned as follows:

Q107: During the year,Martin rented his vacation home

Q108: During the year,Larry rented his vacation home

Q109: In order to protect against rent increases

Q111: Edward operates an illegal drug-running business and

Q112: Taylor,a cash basis architect,rents the building in

Q113: Mattie and Elmer are separated and are

Q114: Bridgett's son,Amos,is $4,500 in arrears on his

Q115: Peter sells land held as an investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents