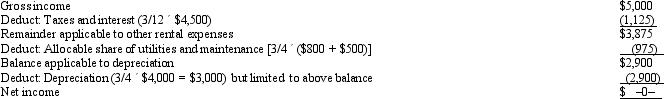

During the year,Martin rented his vacation home for three months and spent one month there.Gross rental income from the property was $5,000.Martin incurred the following expenses: mortgage interest,$3,000;real estate taxes,$1,500;utilities,$800;maintenance,$500;and depreciation,$4,000.Compute Martin's allowable deductions for the vacation home.

Since the vacation home is rented for 15 or more days and is used for personal purposes for more than the greater of (1)14 days or (2)10% of the rental days,the deductions are scaled down,using the court's approach,as follows:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Woody owns a barber shop.The following selected

Q103: While she was a college student,Juliet worked

Q104: Sandra owns an insurance agency.The following selected

Q105: Brenda invested in the following stocks and

Q106: The stock of Eagle,Inc.is owned as follows:

Q108: During the year,Larry rented his vacation home

Q109: In order to protect against rent increases

Q110: Gladys owns a retail hardware store in

Q111: Edward operates an illegal drug-running business and

Q112: Taylor,a cash basis architect,rents the building in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents