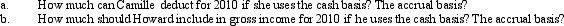

Camille,a calendar year taxpayer,rented a building from Howard for use in her business on November 1,2010.Camille paid $30,000 for 15 months' rent and a $2,500 damage deposit.

Correct Answer:

Verified

Q123: If a taxpayer operated an illegal business

Q127: Graham, a CPA, has submitted a proposal

Q131: Assuming an activity is deemed to be

Q132: Briefly discuss the two tests that an

Q133: What losses are deductible by an individual

Q139: Are there any circumstances under which lobbying

Q139: If part of a shareholder/employee's salary is

Q143: Under what circumstances may a taxpayer deduct

Q143: Are there any exceptions to the rule

Q145: For a vacation home to be classified

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents