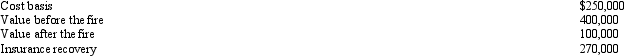

John had adjusted gross income of $60,000.During the year his personal use summer home was damaged by a fire.Pertinent data with respect to the home follows:  John had an accident with his personal use car.As a result of the accident,John was cited with reckless driving and willful negligence.Pertinent data with respect to the car follows:

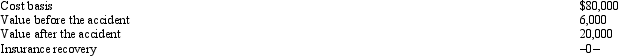

John had an accident with his personal use car.As a result of the accident,John was cited with reckless driving and willful negligence.Pertinent data with respect to the car follows: What is John's deductible casualty loss?

What is John's deductible casualty loss?

A) $0.

B) $15,800.

C) $15,900.

D) $35,900.

E) None of the above.

Correct Answer:

Verified

Q61: Last year, Sarah (who files as single)

Q75: Regarding research and experimental expenditures,which of the

Q76: Last year,Green Corporation incurred the following expenditures

Q78: Cream,Inc.'s taxable income for 2010 before any

Q79: If a taxpayer has an NOL in

Q83: Green,Inc. ,manufactures and sells widgets.During 2010,an examination

Q84: In 2009,Robin Corporation incurred the following expenditures

Q102: How is qualified production activities income (QPAI)

Q104: What are the three methods of handling

Q106: A taxpayer who sustains a casualty loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents