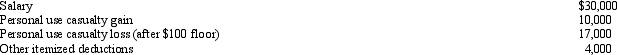

In 2010,Mary had the following items:  Assuming that Mary files as head of household (has one dependent child) ,determine her taxable income for the current year.

Assuming that Mary files as head of household (has one dependent child) ,determine her taxable income for the current year.

A) $14,300.

B) $14,700.

C) $19,000.

D) $24,300.

E) None of the above.

Correct Answer:

Verified

Q49: Three years ago, Sharon loaned her sister

Q52: Five years ago, Tom loaned his son

Q56: Peggy is in the business of factoring

Q57: Two years ago,Gina loaned Tom $50,000.Tom signed

Q62: In 2010,Grant's personal residence was damaged by

Q63: Norm's car,which he uses 100% for personal

Q64: Maria,who is single,had the following items for

Q65: Tonya had the following items for last

Q66: Amber operates her business as a sole

Q76: Which of the following events would produce

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents