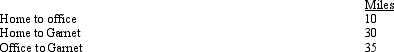

Amy works as an auditor for a large major CPA firm.During the months of September through November of each year,she is permanently assigned to the team auditing Garnet Corporation.As a result,every day she drives from her home to Garnet and returns home after work.Mileage is as follows:  For these three months,Amy's deductible mileage for each workday is:

For these three months,Amy's deductible mileage for each workday is:

A) 0.

B) 30.

C) 35.

D) 60.

E) None of the above.

Correct Answer:

Verified

Q47: In the case of an office in

Q51: If the cost of uniforms is deductible,

Q61: By itself, credit card receipts will constitute

Q62: A traditional IRA may not be rolled

Q64: Ryan performs services for Jordan.Which,if any,of the

Q65: A participant has a zero basis in

Q66: The maximum annual contribution to a Roth

Q67: Employees who render an adequate accounting to

Q74: In which, if any, of the following

Q100: A worker may prefer to be treated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents