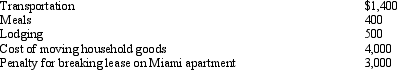

Due to a merger,Allison transfers from Miami to Chicago.Under a new job description,she is reclassified from employee to independent contractor status.Her moving expenses,which are not reimbursed,are as follows:  Allison's deductible moving expense is:

Allison's deductible moving expense is:

A) $0.

B) $5,900.

C) $6,100.

D) $8,900.

E) $9,300.

Correct Answer:

Verified

Q79: Under the actual expense method,which,if any,of the

Q80: Statutory employees:

A)Report their expenses on Form 2106.

B)Include

Q81: Ralph made the following business gifts during

Q82: In contrasting the reporting procedures of employees

Q83: Which of the following expenses,if any,qualify as

Q85: Which,if any,of the following expenses is subject

Q86: Bill is the regional manager for a

Q87: As to meeting the time test for

Q88: During the year,Oscar travels from Raleigh to

Q110: Elaine, the regional sales director for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents