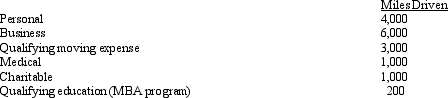

Gus uses his automobile for both business and personal use and claims the automatic mileage rate for all purposes.During 2010,his mileage was as follows:

How much can Gus claim for mileage?

How much can Gus claim for mileage?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q114: Susan is a self-employed accountant with a

Q115: Rachel lives and works in Chicago.She is

Q116: Joyce,age 39,and Sam,age 40,who have been married

Q117: Merrill is a participant in a SIMPLE

Q118: Dirk has $228,000 of earned income in

Q120: A participant,who is age 38,in a cash

Q121: In terms of IRS attitude,what do the

Q122: Meg teaches the fifth grade at a

Q123: Monica has education expenses that qualify for

Q124: Travel status requires that the taxpayer be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents