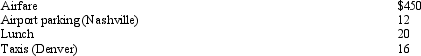

Roberto,a self-employed patent attorney,flew from his home in Nashville to Denver,had lunch alone at the airport,conducted business in the afternoon,and returned to Nashville in the evening.His expenses were as follows:

What is Roberto's deductible expense for the trip?

What is Roberto's deductible expense for the trip?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: Nicole went to London on business.While there,she

Q106: During 2010,Tracy used her car as follows:

Q107: Xijia establishes a Roth IRA at age

Q108: Donna,age 27 and unmarried,is an active participant

Q109: Amanda takes three key clients to a

Q111: Sammy,age 31,is unmarried and is not an

Q112: Dan is employed as an auditor by

Q113: After graduating from college,Dylan obtained employment in

Q114: Susan is a self-employed accountant with a

Q115: Rachel lives and works in Chicago.She is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents