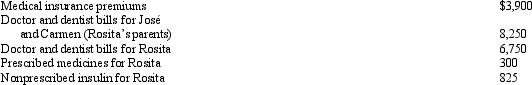

Rosita is employed as a systems analyst.For calendar year 2010,she had AGI of $120,000 and paid the following medical expenses:  José and Carmen would qualify as Rosita's dependents except that they file a joint return.Rosita's medical insurance policy does not cover them.Rosita filed a claim for $3,150 of her own expenses with her insurance company in December 2010 and received the reimbursement in January 2011.What is Rosita's maximum allowable medical expense deduction for 2010?

José and Carmen would qualify as Rosita's dependents except that they file a joint return.Rosita's medical insurance policy does not cover them.Rosita filed a claim for $3,150 of her own expenses with her insurance company in December 2010 and received the reimbursement in January 2011.What is Rosita's maximum allowable medical expense deduction for 2010?

A) $2,775.

B) $11,025.

C) $17,325.

D) $17,775.

E) None of the above.

Correct Answer:

Verified

Q48: Employee business expenses for travel qualify as

Q51: Jerry pays $5,000 tuition to a parochial

Q55: Nancy had an accident while skiing on

Q58: Lonnie developed severe arthritis and was unable

Q58: In order to dissuade his pastor from

Q61: Ron and Tom are equal owners in

Q62: Betty owned stock in General Corporation that

Q63: In Shelby County,the real property tax year

Q64: In 2010,Barry pays a $3,000 premium for

Q65: Joseph and Sandra,married taxpayers,took out a mortgage

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents