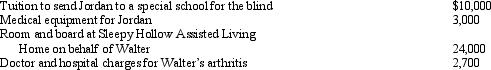

Joe and Nancy are married and file a joint return.They claim Nancy's father (Walter)and Nancy's son (Jordan)as dependents.During the current year,they pay the following expenses:

Walter moved to Sleepy Hollow because he felt living with Joe and Nancy was too noisy.Disregarding percentage limitations,how much qualifies as a medical expense on Joe and Nancy's tax return for:

Walter moved to Sleepy Hollow because he felt living with Joe and Nancy was too noisy.Disregarding percentage limitations,how much qualifies as a medical expense on Joe and Nancy's tax return for:

a.Jordan?

b.Walter?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q91: Linda borrowed $60,000 from her parents for

Q92: Freda,who has AGI of $100,000 in 2010,contributes

Q93: Diane contributed a parcel of land to

Q94: Brian,a self-employed individual,pays state income tax payments

Q95: Paul and Patty Black are married and

Q96: Andrew was injured in an automobile accident

Q97: Victor sold his personal residence to Colleen

Q98: Dawn sold her personal residence to Kevin

Q100: Donald owns a principal residence in Chicago,

Q100: Manny developed a severe heart condition,and his

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents